EPA is readying climate rule for existing power plants as deadline approaches

Via The Washington Post

Juliet Eilperin | 05/21/14 @ 7:46 AM

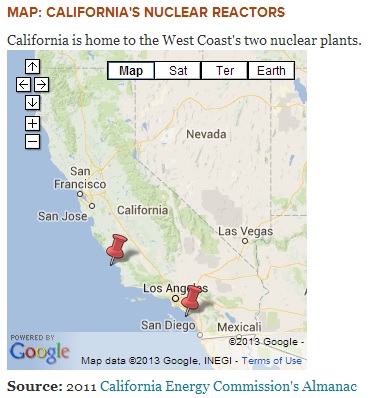

Rich Pedroncelli/Associated Press - Cattle graze near the Sacramento Municipal Utility District's Rancho Seco Nuclear Power Plant. A new climate policy would allow states and companies flexibility in how they will meet emissions standards.

With less than two weeks to go, the Environmental Protection Agency is readying a climate rule for existing power plants that requires steep carbon reductions while allowing states and companies broad flexibility in how they limit their overall greenhouse gas emissions.

While key aspects of the proposal are still under discussion, according to several individuals briefed on the matter, the measure will spur regional carbon trading regimes on the East and West coasts and is likely to spur a legal challenge from some utilities. As currently drafted, the rule would cut greenhouse gas emissions from the utility sector by 25 percent, individuals said, but the baseline for that reduction has not been finalized.

The EPA plan resembles proposals made by the Natural Resources Defense Council, which would allow states and companies to employ a variety of measures — including new renewable energy and energy efficiency projects “outside the fence,” or away from the power plant site itself — to meet their carbon reduction target. The exact level of reduction will vary by state, according to those familiar with the rule, and it will consist of a two-step process that will have smaller reductions at first and larger ones by 2030.

Coal-intensive utilities, coal mining companies, the U.S. Chamber of Commerce, conservative think tanks and a dozen or so state attorneys general have lined up to challenge the basis for the EPA’s impending draft regulations for limiting carbon dioxide emissions at existing coal plants. They have taken aim both at the likelihood that the EPA will set emissions targets and at any approach that isn’t limited to a specific plant site.

“Any standard that is set predicated on reductions happening outside the fence line are illegal and would be overturned by the court,” said Joseph Stanko, who heads government relations at the law firm Hunton and Williams and represents several utility companies. “And I think they know that.”

The proposed rule, which will be announced June 2, represents the centerpiece ofPresident Obama’s climate action plan. Utilities account for roughly 40 percent of the nation’s carbon dioxide emissions, with much of it coming from the aging, coal-fired fleet.

“This is a magic moment for the President — a chance to write his name into the record books,” wrote Frank O’Donnell, who directs the advocacy group Clean Air Watch. “But history will ultimately judge this less by an excellent speech than by the final contents and outcome of this initiative.”

The EPA declined to comment on the draft rule. Both Bloomberg News and Reuters reported some of the proposals over the past few days.

Kelly Speakes-Backman, who is both commissioner of the Maryland Public Service Commission and chairs the board of directors of the Regional Greenhouse Gas Initiative, a nine-state emissions trading compact, said in an interview last week that a “mass-based” system allows states and utilities to cut carbon in a more efficient and cost-effective way. Under this system, which is what the EPA is poised to adopt, states will have to meet an overall greenhouse gas limit rather than a specific rate per hour for each power plant.

“What are we ultimately trying to do? We’re trying to reduce carbon in the atmosphere,” she said, adding: “What RGGI has been doing sets almost a plug-and-play model for other states to adopt.”

Some, like Washington state, are eager to follow the example of the East Coast and California, both of whom have adopted emission-trading schemes. The RGGI program applies only to power plants while California’s system is much broader; the states participating in the RGGI system cut their emissions by more than 40 percent between 2005 and 2012.

EPA Administrator Gina McCarthy is traveling this week to Utah, Washington and Oregon, where she will meet with each state’s governor and also hold public events. Washington Gov. Jay Inslee (D) has pressed the EPA to adopt a strict carbon standard and is currently pushing for several policies so his state can meet its goal of reducing its overall emissions 20 percent by 2020.

Stu Clark, air program manager at the state’s Ecology Department, said the EPA has conducted “an unprecedented outreach” in crafting the rule. He added that depending on how stiff the requirements are, Washington may need to strike a regional compact with other states even though its utility sector is relatively clean.

“If it’s a really stringent standard, we will need to look at a broader suite of tools,” Clark said.

Other states are more resistant. Oklahoma Attorney General E. Scott Pruitt, for example, argued at the National Press Club Tuesday that the Clean Air Act gives states the power to determine what pollution standards should be and how to achieve them. Only later, he said, can the EPA reject a state’s plan and impose its own, so the EPA’s task now is to design a procedure and general emissions guidelines. He said it was reducing the states “from a substantive to an administrative role.”

“I find it offensive that the EPA feels regulators in states are not interested in air quality or pollution,” he said. And he said that the EPA has a “dictatorial attitude that as long as you agree with us, everything is kosher.”

Pruitt also said that EPA can only regulate single sites “unit by unit” rather than offer states and utilities the flexibility of meeting new guidelines through energy efficiency programs or renewable investments that might not be on the site of a regulated coal plant. Pruitt said that in such an approach “EPA is using its power to pick winners and losers.”

But David Doniger, policy director for NRDC’s climate and clean air program, said the EPA does have the authority to set an overall carbon limit. Since there was a limited amount of improvement to boost the efficiency of existing coal plants, he said, using the broader approach could help meet deeper reductions in carbon emissions at lower costs.

Doniger said that the EPA’s authority had been clearly recognized by the Supreme Court both in American Electric Power Co. v. Connecticut and in Massachusetts v. EPA. “I don’t think there’s much ambiguity there,” he said.

NRDC supports establishing a three-year baseline for power plant emissions, starting either in 2005 or 2008, and allow states and utilities to take credit for anything — new nuclear plants, energy efficiency, carbon capture and storage — that reduced carbon emissions.

Pruitt also attacked a plan drawn up for Kentucky that he said was based on “mass emissions.” He said it would act as a “cap and trade system — without the trading.”

In fact, the EPA’s proposal is likely to more closely resemble renewable portfolio standards already in effect in about 30 states and the District of Columbia. Those states would likely have an easier time meeting new guidelines for existing plants if the EPA opts for an “outside the fence” approach to power plants.

Utility executives say that the retirement of coal plants dating back to the Eisenhower era could also help meet targets if companies are allowed to average steps taken at one site with emissions at another.

Some companies who have invested heavily in nuclear power — such as Exelon, where nearly 91 percent of its fleet is nuclear — backs a strict carbon standard for existing plants. Joe Dominguez, Exelon’s senior vice president of governmental, regulatory affairs and public policy, said several of its 24 units may not be economically viable if the EPA’s proposal is not stringent.

“We think the reality is in the absence of carbon policy, it’s going to be difficult to keep the existing baseload of clean energy in service,” he said.

The wind industry is also lobbying for an “outside the fence” approach so that companies can add wind power as a strategy. “The EPA rule is going to be doable and affordable assuming wind and other renewables count,” said Tom Vinson of the American Wind Energy Association. Rob Gramlich, senior vice president for public policy at AWEA added: “if EPA rules only apply inside the fence, less stringent standards will be needed.”

Vinson said existing coal plants could achieve no more than 3 to 5 percent efficiency gains, far less than the carbon emission cuts the EPA is expected to demand.

While key aspects of the proposal are still under discussion, according to several individuals briefed on the matter, the measure will spur regional carbon trading regimes on the East and West coasts and is likely to spur a legal challenge from some utilities. As currently drafted, the rule would cut greenhouse gas emissions from the utility sector by 25 percent, individuals said, but the baseline for that reduction has not been finalized.

The EPA plan resembles proposals made by the Natural Resources Defense Council, which would allow states and companies to employ a variety of measures — including new renewable energy and energy efficiency projects “outside the fence,” or away from the power plant site itself — to meet their carbon reduction target. The exact level of reduction will vary by state, according to those familiar with the rule, and it will consist of a two-step process that will have smaller reductions at first and larger ones by 2030.

Coal-intensive utilities, coal mining companies, the U.S. Chamber of Commerce, conservative think tanks and a dozen or so state attorneys general have lined up to challenge the basis for the EPA’s impending draft regulations for limiting carbon dioxide emissions at existing coal plants. They have taken aim both at the likelihood that the EPA will set emissions targets and at any approach that isn’t limited to a specific plant site.

“Any standard that is set predicated on reductions happening outside the fence line are illegal and would be overturned by the court,” said Joseph Stanko, who heads government relations at the law firm Hunton and Williams and represents several utility companies. “And I think they know that.”

The proposed rule, which will be announced June 2, represents the centerpiece ofPresident Obama’s climate action plan. Utilities account for roughly 40 percent of the nation’s carbon dioxide emissions, with much of it coming from the aging, coal-fired fleet.

“This is a magic moment for the President — a chance to write his name into the record books,” wrote Frank O’Donnell, who directs the advocacy group Clean Air Watch. “But history will ultimately judge this less by an excellent speech than by the final contents and outcome of this initiative.”

The EPA declined to comment on the draft rule. Both Bloomberg News and Reuters reported some of the proposals over the past few days.

Kelly Speakes-Backman, who is both commissioner of the Maryland Public Service Commission and chairs the board of directors of the Regional Greenhouse Gas Initiative, a nine-state emissions trading compact, said in an interview last week that a “mass-based” system allows states and utilities to cut carbon in a more efficient and cost-effective way. Under this system, which is what the EPA is poised to adopt, states will have to meet an overall greenhouse gas limit rather than a specific rate per hour for each power plant.

“What are we ultimately trying to do? We’re trying to reduce carbon in the atmosphere,” she said, adding: “What RGGI has been doing sets almost a plug-and-play model for other states to adopt.”

Some, like Washington state, are eager to follow the example of the East Coast and California, both of whom have adopted emission-trading schemes. The RGGI program applies only to power plants while California’s system is much broader; the states participating in the RGGI system cut their emissions by more than 40 percent between 2005 and 2012.

EPA Administrator Gina McCarthy is traveling this week to Utah, Washington and Oregon, where she will meet with each state’s governor and also hold public events. Washington Gov. Jay Inslee (D) has pressed the EPA to adopt a strict carbon standard and is currently pushing for several policies so his state can meet its goal of reducing its overall emissions 20 percent by 2020.

Stu Clark, air program manager at the state’s Ecology Department, said the EPA has conducted “an unprecedented outreach” in crafting the rule. He added that depending on how stiff the requirements are, Washington may need to strike a regional compact with other states even though its utility sector is relatively clean.

“If it’s a really stringent standard, we will need to look at a broader suite of tools,” Clark said.

Other states are more resistant. Oklahoma Attorney General E. Scott Pruitt, for example, argued at the National Press Club Tuesday that the Clean Air Act gives states the power to determine what pollution standards should be and how to achieve them. Only later, he said, can the EPA reject a state’s plan and impose its own, so the EPA’s task now is to design a procedure and general emissions guidelines. He said it was reducing the states “from a substantive to an administrative role.”

“I find it offensive that the EPA feels regulators in states are not interested in air quality or pollution,” he said. And he said that the EPA has a “dictatorial attitude that as long as you agree with us, everything is kosher.”

Pruitt also said that EPA can only regulate single sites “unit by unit” rather than offer states and utilities the flexibility of meeting new guidelines through energy efficiency programs or renewable investments that might not be on the site of a regulated coal plant. Pruitt said that in such an approach “EPA is using its power to pick winners and losers.”

But David Doniger, policy director for NRDC’s climate and clean air program, said the EPA does have the authority to set an overall carbon limit. Since there was a limited amount of improvement to boost the efficiency of existing coal plants, he said, using the broader approach could help meet deeper reductions in carbon emissions at lower costs.

Doniger said that the EPA’s authority had been clearly recognized by the Supreme Court both in American Electric Power Co. v. Connecticut and in Massachusetts v. EPA. “I don’t think there’s much ambiguity there,” he said.

NRDC supports establishing a three-year baseline for power plant emissions, starting either in 2005 or 2008, and allow states and utilities to take credit for anything — new nuclear plants, energy efficiency, carbon capture and storage — that reduced carbon emissions.

Pruitt also attacked a plan drawn up for Kentucky that he said was based on “mass emissions.” He said it would act as a “cap and trade system — without the trading.”

In fact, the EPA’s proposal is likely to more closely resemble renewable portfolio standards already in effect in about 30 states and the District of Columbia. Those states would likely have an easier time meeting new guidelines for existing plants if the EPA opts for an “outside the fence” approach to power plants.

Utility executives say that the retirement of coal plants dating back to the Eisenhower era could also help meet targets if companies are allowed to average steps taken at one site with emissions at another.

Some companies who have invested heavily in nuclear power — such as Exelon, where nearly 91 percent of its fleet is nuclear — backs a strict carbon standard for existing plants. Joe Dominguez, Exelon’s senior vice president of governmental, regulatory affairs and public policy, said several of its 24 units may not be economically viable if the EPA’s proposal is not stringent.

“We think the reality is in the absence of carbon policy, it’s going to be difficult to keep the existing baseload of clean energy in service,” he said.

The wind industry is also lobbying for an “outside the fence” approach so that companies can add wind power as a strategy. “The EPA rule is going to be doable and affordable assuming wind and other renewables count,” said Tom Vinson of the American Wind Energy Association. Rob Gramlich, senior vice president for public policy at AWEA added: “if EPA rules only apply inside the fence, less stringent standards will be needed.”

Vinson said existing coal plants could achieve no more than 3 to 5 percent efficiency gains, far less than the carbon emission cuts the EPA is expected to demand.

Time for L.A. to embrace energy blessings of the sun: Opinion

Via Los Angeles Daily News Opinion

Allis Druffel and Lee Wallach. Posted 01/15/14, 2:32 PM PST

Los Angeles enjoys more than 300 days of sunshine a year, enough to power most of the city’s homes, businesses, schools, congregations, factories and warehouses with solar energy. But right now, L.A. is not taking advantage of this immense blessing: the city gets less than 2 percent of its power from the sun.

As people of faith, we believe that we have an obligation to generate power in a way that does not put our health and our environment at risk. Unfortunately, most of L.A.’s electricity currently comes from harmful fossil fuels, which contribute to global warming, thereby exacerbating extreme weather such as wildfires and droughts. Fossil fuel plants consume huge amounts of fresh water. They spew air pollution that can lead to serious health problems, including asthma, which affects more than one million people in Los Angeles County.

We represent Christian, Jewish, Hindu, Muslim and Unitarian Universalist congregations that believe in solar power as a way to put religious values like environmental stewardship and social justice into action. Some of these congregations — including First Unitarian in Koreatown, St. Andrew’s Lutheran in Mar Vista and the Vedanta Society in Hollywood — have already installed solar rooftop panels on their own buildings. Solar energy allows communities of faith to reduce air pollution, protect people’s health, fight climate change and create local jobs.

Rooftop solar power also has direct economic benefits. Metropolitan Community Church in the Valley, for instance, used to pay $350 a month for electricity. After installing 90 solar panels on the church roof, the bills have dropped to $60 or $70. The church pays lease payments on the panels, but even so, the congregation is able to save money each month by using solar power.

Thousands of L.A. homeowners, small businesses, factories, schools, and apartment complexes are also reaping the environmental and economic benefits of choosing solar. But with only a tiny fraction of L.A.’s power coming from the sun, our city still has a long way to go. While campaigning last spring, Mayor Eric Garcetti called for the city of Los Angeles to get at least 20 percent of its power from local solar by 2020. According to research from Environment California Research & Policy Center, achieving 20 percent solar power by 2020 would reduce global warming pollution by over 1 million tons per year, cut smog-forming pollution by about 730,000 tons per year, and create an estimated 32,000 jobs.

Mayor Garcetti and the City Council can make this vision a reality by turning 20 percent solar by 2020 into an official city goal. They should also work with the Los Angeles Department of Water and Power to simplify permitting and billing procedures, expand incentive programs, and increase access to solar for nonprofit groups, multi-family housing units and low-income homeowners.

Los Angeles is at a pivotal juncture. The Department of Water and Power will need to replace more than 70 percent of its generating capacity over the next 15 years. DWP is making decisions right now that will affect our energy landscape for decades to come. The city faces a choice: new in-basin fossil fuel plants that will lock Angelenos into dirty power for decades, or an expanded commitment to renewable energy and rooftop solar power.

It’s time for our city to embrace the blessings of the sun.

Allis Druffel is with Southern California Interfaith Power and Light. Lee Wallach is with the Coalition on the Environment and Jewish Life of Southern California.

Rev. Rick Hoy of First Unitarian Church of Los Angeles, Pastor Caleb Crainer of St. Andrew’s Lutheran Church and Rev. Dr. Robert Shore-Goss of Metropolitan Community Church in the Valley also contributed.

Organic mega flow battery promises breakthrough for renewable energy

Via Harvard School of Engineering and Applied Sciences

HARVARD TECHNOLOGY COULD ECONOMICALLY STORE ENERGY FOR USE WHEN THE WIND DOESN'T BLOW AND THE SUN DOESN'T SHINE

January 8, 2014

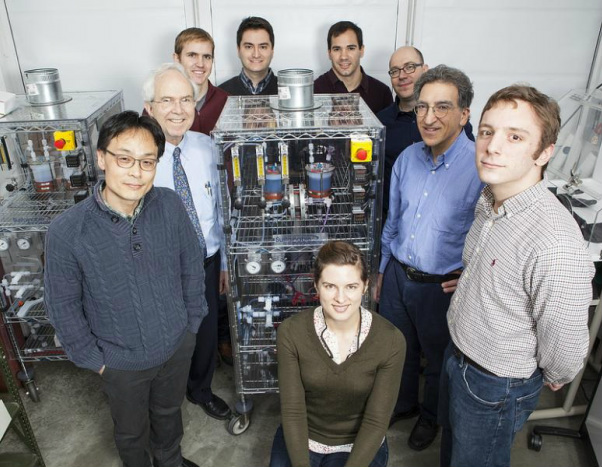

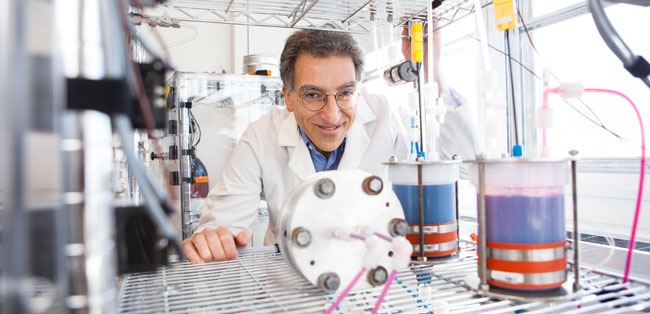

Michael J. Aziz (pictured) and others at Harvard University have developed a metal-free flow battery that relies on the electrochemistry of naturally abundant, small organic molecules to store electricity generated from renewable, intermittent energy sources. (Photo by Eliza Grinnell, SEAS Communications.)

Cambridge, Mass. – January 8, 2014 – A team of Harvard scientists and engineers has demonstrated a new type of battery that could fundamentally transform the way electricity is stored on the grid, making power from renewable energy sources such as wind and solar far more economical and reliable.

The novel battery technology is reported in a paper published in Natureon January 9. Under the OPEN 2012 program, the Harvard team received funding from the U.S. Department of Energy’s Advanced Research Projects Agency–Energy (ARPA-E) to develop the innovative grid-scale battery and plans to work with ARPA-E to catalyze further technological and market breakthroughs over the next several years.

The paper reports a metal-free flow battery that relies on the electrochemistry of naturally abundant, inexpensive, small organic (carbon-based) molecules called quinones, which are similar to molecules that store energy in plants and animals.

The mismatch between the availability of intermittent wind or sunshine and the variability of demand is the biggest obstacle to getting a large fraction of our electricity from renewable sources. A cost-effective means of storing large amounts of electrical energy could solve this problem.

The battery was designed, built, and tested in the laboratory of Michael J. Aziz, Gene and Tracy Sykes Professor of Materials and Energy Technologies at the Harvard School of Engineering and Applied Sciences (SEAS). Roy G. Gordon, Thomas Dudley Cabot Professor of Chemistry and Professor of Materials Science, led the work on the synthesis and chemical screening of molecules. Alán Aspuru-Guzik, Professor of Chemistry and Chemical Biology, used his pioneering high-throughput molecular screening methods to calculate the properties of more than 10,000 quinone molecules in search of the best candidates for the battery.

Flow batteries store energy in chemical fluids contained in external tanks—as with fuel cells—instead of within the battery container itself. The two main components—the electrochemical conversion hardware through which the fluids are flowed (which sets the peak power capacity), and the chemical storage tanks (which set the energy capacity)—may be independently sized. Thus the amount of energy that can be stored is limited only by the size of the tanks. The design permits larger amounts of energy to be stored at lower cost than with traditional batteries.

By contrast, in solid-electrode batteries, such as those commonly found in cars and mobile devices, the power conversion hardware and energy capacity are packaged together in one unit and cannot be decoupled. Consequently they can maintain peak discharge power for less than an hour before being drained, and are therefore ill suited to store intermittent renewables.

“Our studies indicate that one to two days' worth of storage is required for making solar and wind dispatchable through the electrical grid,” said Aziz.

To store 50 hours of energy from a 1-megawatt power capacity wind turbine (50 megawatt-hours), for example, a possible solution would be to buy traditional batteries with 50 megawatt-hours of energy storage, but they'd come with 50 megawatts of power capacity. Paying for 50 megawatts of power capacity when only 1 megawatt is necessary makes little economic sense.

For this reason, a growing number of engineers have focused their attention on flow battery technology. But until now, flow batteries have relied on chemicals that are expensive or difficult to maintain, driving up the energy storage costs.

The active components of electrolytes in most flow batteries have been metals. Vanadium is used in the most commercially advanced flow battery technology now in development, but its cost sets a rather high floor on the cost per kilowatt-hour at any scale. Other flow batteries contain precious metal electrocatalysts such as the platinum used in fuel cells.

The new flow battery developed by the Harvard team already performs as well as vanadium flow batteries, with chemicals that are significantly less expensive, and with no precious metal electrocatalyst.

“The whole world of electricity storage has been using metal ions in various charge states but there is a limited number that you can put into solution and use to store energy, and none of them can economically store massive amounts of renewable energy,” Gordon said. “With organic molecules, we introduce a vast new set of possibilities. Some of them will be terrible and some will be really good. With these quinones we have the first ones that look really good.”

Aspuru-Guzik noted that the project is very well aligned with the White House Materials Genome Initiative. “This project illustrates what the synergy of high-throughput quantum chemistry and experimental insight can do,” he said. “In a very quick time period, our team honed in to the right molecule. Computational screening, together with experimentation, can lead to discovery of new materials in many application domains.”

Quinones are abundant in crude oil as well as in green plants. The molecule that the Harvard team used in its first quinone-based flow battery is almost identical to one found in rhubarb. The quinones are dissolved in water, which prevents them from catching fire.

To back up a commercial wind turbine, a large storage tank would be needed, possibly located in a below-grade basement, said co-lead author Michael Marshak, a postdoctoral fellow at SEAS and in the Department of Chemistry and Chemical Biology. Or if you had a whole field of turbines or large solar farm, you could imagine a few very large storage tanks.

The same technology could also have applications at the consumer level, Marshak said. “Imagine a device the size of a home heating oil tank sitting in your basement. It would store a day’s worth of sunshine from the solar panels on the roof of your house, potentially providing enough to power your household from late afternoon, through the night, into the next morning, without burning any fossil fuels.”

By contrast, in solid-electrode batteries, such as those commonly found in cars and mobile devices, the power conversion hardware and energy capacity are packaged together in one unit and cannot be decoupled. Consequently they can maintain peak discharge power for less than an hour before being drained, and are therefore ill suited to store intermittent renewables.

“Our studies indicate that one to two days' worth of storage is required for making solar and wind dispatchable through the electrical grid,” said Aziz.

To store 50 hours of energy from a 1-megawatt power capacity wind turbine (50 megawatt-hours), for example, a possible solution would be to buy traditional batteries with 50 megawatt-hours of energy storage, but they'd come with 50 megawatts of power capacity. Paying for 50 megawatts of power capacity when only 1 megawatt is necessary makes little economic sense.

For this reason, a growing number of engineers have focused their attention on flow battery technology. But until now, flow batteries have relied on chemicals that are expensive or difficult to maintain, driving up the energy storage costs.

The active components of electrolytes in most flow batteries have been metals. Vanadium is used in the most commercially advanced flow battery technology now in development, but its cost sets a rather high floor on the cost per kilowatt-hour at any scale. Other flow batteries contain precious metal electrocatalysts such as the platinum used in fuel cells.

The new flow battery developed by the Harvard team already performs as well as vanadium flow batteries, with chemicals that are significantly less expensive, and with no precious metal electrocatalyst.

“The whole world of electricity storage has been using metal ions in various charge states but there is a limited number that you can put into solution and use to store energy, and none of them can economically store massive amounts of renewable energy,” Gordon said. “With organic molecules, we introduce a vast new set of possibilities. Some of them will be terrible and some will be really good. With these quinones we have the first ones that look really good.”

Aspuru-Guzik noted that the project is very well aligned with the White House Materials Genome Initiative. “This project illustrates what the synergy of high-throughput quantum chemistry and experimental insight can do,” he said. “In a very quick time period, our team honed in to the right molecule. Computational screening, together with experimentation, can lead to discovery of new materials in many application domains.”

Quinones are abundant in crude oil as well as in green plants. The molecule that the Harvard team used in its first quinone-based flow battery is almost identical to one found in rhubarb. The quinones are dissolved in water, which prevents them from catching fire.

To back up a commercial wind turbine, a large storage tank would be needed, possibly located in a below-grade basement, said co-lead author Michael Marshak, a postdoctoral fellow at SEAS and in the Department of Chemistry and Chemical Biology. Or if you had a whole field of turbines or large solar farm, you could imagine a few very large storage tanks.

The same technology could also have applications at the consumer level, Marshak said. “Imagine a device the size of a home heating oil tank sitting in your basement. It would store a day’s worth of sunshine from the solar panels on the roof of your house, potentially providing enough to power your household from late afternoon, through the night, into the next morning, without burning any fossil fuels.”

“The Harvard team’s results published in Nature demonstrate an early, yet important technical achievement that could be critical in furthering the development of grid-scale batteries,” said ARPA-E Program Director John Lemmon. “The project team’s result is an excellent example of how a small amount of catalytic funding from ARPA-E can help build the foundation to hopefully turn scientific discoveries into low-cost, early-stage energy technologies.”

Team leader Aziz said the next steps in the project will be to further test and optimize the system that has been demonstrated on the bench top and bring it toward a commercial scale. “So far, we've seen no sign of degradation after more than 100 cycles, but commercial applications require thousands of cycles,” he said. He also expects to achieve significant improvements in the underlying chemistry of the battery system. “I think the chemistry we have right now might be the best that’s out there for stationary storage and quite possibly cheap enough to make it in the marketplace,” he said. “But we have ideas that could lead to huge improvements.”

By the end of the three-year development period, Connecticut-basedSustainable Innovations, LLC, a collaborator on the project, expects to deploy demonstration versions of the organic flow battery contained in a unit the size of a horse trailer. The portable, scaled-up storage system could be hooked up to solar panels on the roof of a commercial building, and electricity from the solar panels could either directly supply the needs of the building or go into storage and come out of storage when there’s a need. Sustainable Innovations anticipates playing a key role in the product’s commercialization by leveraging its ultra-low cost electrochemical cell design and system architecture already under development for energy storage applications.

“You could theoretically put this on any node on the grid,” Aziz said. “If the market price fluctuates enough, you could put a storage device there and buy electricity to store it when the price is low and then sell it back when the price is high. In addition, you might be able to avoid the permitting and gas supply problems of having to build a gas-fired power plant just to meet the occasional needs of a growing peak demand.”

This technology could also provide very useful backup for off-grid rooftop solar panels—an important advantage considering some 20 percent of the world’s population does not have access to a power distribution network.

William Hogan, Raymond Plank Professor of Global Energy Policy at Harvard Kennedy School, and one of the world’s foremost experts on electricity markets, is helping the team explore the economic drivers for the technology.

Trent M. Molter, President and CEO of Sustainable Innovations, LLC, provides expertise on implementing the Harvard team’s technology into commercial electrochemical systems.

“The intermittent renewables storage problem is the biggest barrier to getting most of our power from the sun and the wind,” Aziz said. “A safe and economical flow battery could play a huge role in our transition off fossil fuels to renewable electricity. I'm excited that we have a good shot at it.”

In addition to Aziz, Marshak, Aspuru-Guzik, and Gordon, the co-lead author of the Nature paper was Brian Huskinson, a graduate student with Aziz; coauthors included research associate Changwon Suh and postdoctoral researcher Süleyman Er in Aspuru-Guzik’s group; Michael Gerhardt, a graduate student with Aziz; Cooper Galvin, a Pomona College undergraduate; and Xudong Chen, a postdoctoral fellow in Gordon’s group.

This work was supported in part by the U.S. Department of Energy’s Advanced Research Project Agency–Energy (ARPA-E), the Harvard School of Engineering and Applied Sciences, the National Science Foundation (NSF) Extreme Science and Engineering Discovery Environment (OCI-1053575), an NSF Graduate Research Fellowship, and the Fellowships for Young Energy Scientists program of the Foundation for Fundamental Research on Matter, which is part of the Netherlands Organization for Scientific Research (NWO).

Team leader Aziz said the next steps in the project will be to further test and optimize the system that has been demonstrated on the bench top and bring it toward a commercial scale. “So far, we've seen no sign of degradation after more than 100 cycles, but commercial applications require thousands of cycles,” he said. He also expects to achieve significant improvements in the underlying chemistry of the battery system. “I think the chemistry we have right now might be the best that’s out there for stationary storage and quite possibly cheap enough to make it in the marketplace,” he said. “But we have ideas that could lead to huge improvements.”

By the end of the three-year development period, Connecticut-basedSustainable Innovations, LLC, a collaborator on the project, expects to deploy demonstration versions of the organic flow battery contained in a unit the size of a horse trailer. The portable, scaled-up storage system could be hooked up to solar panels on the roof of a commercial building, and electricity from the solar panels could either directly supply the needs of the building or go into storage and come out of storage when there’s a need. Sustainable Innovations anticipates playing a key role in the product’s commercialization by leveraging its ultra-low cost electrochemical cell design and system architecture already under development for energy storage applications.

“You could theoretically put this on any node on the grid,” Aziz said. “If the market price fluctuates enough, you could put a storage device there and buy electricity to store it when the price is low and then sell it back when the price is high. In addition, you might be able to avoid the permitting and gas supply problems of having to build a gas-fired power plant just to meet the occasional needs of a growing peak demand.”

This technology could also provide very useful backup for off-grid rooftop solar panels—an important advantage considering some 20 percent of the world’s population does not have access to a power distribution network.

William Hogan, Raymond Plank Professor of Global Energy Policy at Harvard Kennedy School, and one of the world’s foremost experts on electricity markets, is helping the team explore the economic drivers for the technology.

Trent M. Molter, President and CEO of Sustainable Innovations, LLC, provides expertise on implementing the Harvard team’s technology into commercial electrochemical systems.

“The intermittent renewables storage problem is the biggest barrier to getting most of our power from the sun and the wind,” Aziz said. “A safe and economical flow battery could play a huge role in our transition off fossil fuels to renewable electricity. I'm excited that we have a good shot at it.”

In addition to Aziz, Marshak, Aspuru-Guzik, and Gordon, the co-lead author of the Nature paper was Brian Huskinson, a graduate student with Aziz; coauthors included research associate Changwon Suh and postdoctoral researcher Süleyman Er in Aspuru-Guzik’s group; Michael Gerhardt, a graduate student with Aziz; Cooper Galvin, a Pomona College undergraduate; and Xudong Chen, a postdoctoral fellow in Gordon’s group.

This work was supported in part by the U.S. Department of Energy’s Advanced Research Project Agency–Energy (ARPA-E), the Harvard School of Engineering and Applied Sciences, the National Science Foundation (NSF) Extreme Science and Engineering Discovery Environment (OCI-1053575), an NSF Graduate Research Fellowship, and the Fellowships for Young Energy Scientists program of the Foundation for Fundamental Research on Matter, which is part of the Netherlands Organization for Scientific Research (NWO).

Power struggle: Green energy versus a grid that's not ready

Minders of a fragile national power grid say the rush to renewable energy might actually make it harder to keep the lights on.

Via LA Times

Evan Halper. December 2, 2013 | 7:57 p.m.

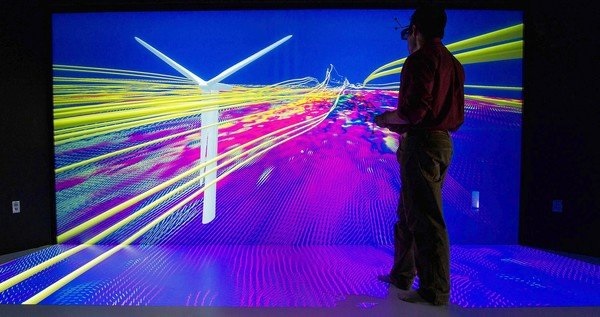

A scientist studies a wind turbine simulation at the Energy Systems Integration Facility in Golden, Colo.

(Dennis Schroeder / National Renewable / December 3, 2013)

(Dennis Schroeder / National Renewable / December 3, 2013)

WASHINGTON — In a sprawling complex of laboratories and futuristic gadgets in Golden, Colo., a supercomputer named Peregrine does a quadrillion calculations per second to help scientists figure out how to keep the lights on.

Peregrine was turned on this year by the U.S. Energy Department. It has the world's largest "petascale" computing capability. It is the size of a Mack truck.

Its job is to figure out how to cope with a risk from something the public generally thinks of as benign — renewable energy.

Energy officials worry a lot these days about the stability of the massive patchwork of wires, substations and algorithms that keeps electricity flowing. They rattle off several scenarios that could lead to a collapse of the power grid — a well-executed cyberattack, a freak storm, sabotage.

But as states, led by California, race to bring more wind, solar and geothermal power online, those and other forms of alternative energy have become a new source of anxiety. The problem is that renewable energy adds unprecedented levels of stress to a grid designed for the previous century.

Green energy is the least predictable kind. Nobody can say for certain when the wind will blow or the sun will shine. A field of solar panels might be cranking out huge amounts of energy one minute and a tiny amount the next if a thick cloud arrives. In many cases, renewable resources exist where transmission lines don't.

"The grid was not built for renewables," said Trieu Mai, senior analyst at the National Renewable Energy Laboratory.

The frailty imperils lofty goals for greenhouse gas reductions. Concerned state and federal officials are spending billions of dollars in ratepayer and taxpayer money in an effort to hasten the technological breakthroughs needed for the grid to keep up with the demands of clean energy.

Making a green energy future work will be "one of the greatest technological challenges industrialized societies have undertaken," a group of scholars at Caltech said in a recent report. The report notes that by 2030, about $1 trillion is expected to be spent nationwide in bringing the grid up to date.

The role of the grid is to keep the supply of power steady and predictable. Engineers carefully calibrate how much juice to feed into the system as everything from porch lights to factory machines are switched on and off. The balancing requires painstaking precision. A momentary overload can crash the system.

California has taken some of the earliest steps to address the problems. The California Public Utilities Commission last month ordered large power companies to invest heavily in efforts to develop storage technologies that could bottle up wind and solar power, allowing the energy to be distributed more evenly over time.

Whether those technologies will ever be economically viable on a large scale is hotly debated. The commission mandate nonetheless requires companies to produce enough storage by 2024 to power about 1 million homes.

"Energy storage has the potential to be a game changer for our electric grid," Commissioner Mark Ferron said.

Some utility officials warn, however, that the only guarantee is that ratepayers will be spending a lot. The commission's goals, while laudable, "could cost up to $3 billion with uncertain net benefits for customers," Southern California Edison declared in a filing.

But regulators are desperate to move past the status quo. Already, power grid operators in some states have had to dump energy produced by wind turbines on blustery days because regional power systems had no room for it. Officials at the California Independent System Operator, which manages the grid in California, say renewable energy producers are making the juggling act increasingly complex.

"We are getting to the point where we will have to pay people not to produce power," said Long Beach Mayor Bob Foster, a system operator board member.

A bigger fear is that the grid is becoming more vulnerable to collapse, leaving the public exposed to the kind of blackouts that hit San Diego, parts of Arizona and a chunk of Baja California on a blistering hot September day in 2011.

Rush-hour traffic jammed as streetlights went dark. Flights were grounded. Pumping stations came to a halt, causing sewage to flow onto beaches. People were trapped in office elevators and on rides at Sea World.

An employee's misstep at a substation near Yuma, Ariz., caused that blackout, but energy experts see it as a harbinger of the sorts of problems that could become frequent if the nation fails to refashion its outmoded power grid.

Foster has been working with other regulators and power company executives to redesign the system. The work involves ideas for mapping and building vast networks of electrical lines, industrial-scale solar- and wind-power plants and backup natural gas plants that can keep the lights on when shifts in weather cause renewable sources to falter. That's the tangible stuff they can easily explain.

But the grid is also built on an antiquated tangle of market rules, operational formulas and business models. It makes for a formidable riddle.

Planners are struggling to plot where and when to deploy solar panels, wind turbines and hydrogen fuel cells without knowing whether regulators will approve the transmission lines to support them.

"One of the biggest challenges is you can't create a market for these resources without solving the demands of moving electricity from one physical place to another," said Neil Fromer, executive director of Caltech's Resnick Sustainability Institute. "But you can't solve that problem until you understand what the market structure looks like."

Back in Colorado, Peregrine is furiously working to map out grid scenarios involving wind, solar and other forms of renewable energy. Sharing space with Peregrine at the Energy Systems Integration Facility is a "visualization room" with a 16-foot screen that creates 3-D images of how different wind patterns interact with turbines, or how molecules interact inside a solar cell.

Federal regulators see an expanded role for themselves as the best hope for powering the nation with as much as 80% renewable energy within the next 35 or so years. Maintaining stability will hinge increasingly on interstate cooperation, they say.

But state regulators are reluctant to cede authority. That's particularly true in California, where bitterness over the energy crisis of more than a decade ago remains intense and makes officials reluctant to cede an inch of jurisdiction to Washington.

Regardless of who wins that power struggle, some of those involved in the day-to-day business of keeping the lights on in California say the limitations of the grid will undermine efforts by activists to move more quickly to reduce greenhouse gas emissions from power plants.

At the Independent Energy Producers Assn. in Sacramento, which represents owners of renewable and gas power plants, Executive Director Jan Smutny-Jones says proposals by academics and others to move California to as much as 80% renewable energy within the next two decades are bumping up against the challenges of avoiding another San Diego-type blackout.

"Some day that may be the way the world is going to work," he said. "But in the next five or six years, it is not."

[email protected]

Tesla's Huge Battery Deal Suggests Sales Could Quintuple Within 4 Years

Via Forbes

TECH | 10/30/2013 @ 5:24AM

Tesla stores could be awfully busy in the years to come if the companies bet right on batteries.

Tesla Motors and battery supplier Panasonic went back to the drawing board. Two years ago, the two firms made a deal under which Panasonic would supply Tesla with enough batteries to build 80,000 cars over 4 years. With Tesla on track to deliver more than 21,000 vehicles this year alone and having already set a goal ofdoubling production by the end of next year, a new supply agreement with Panasonic was needed. Today, the two companies announced that Panasonic will supply nearly 2 billion battery cells to Tesla over the coming 4 years, for both the Model S sedan and the forthcoming Model X, sport utility vehicle. With the largest Tesla pack using around 7000 cells, the quantity involved is enough for close to 300,000 vehicles. Given that sales will grow over time, it seems likely Tesla is preparing to reach 100,000+ vehicles sold in the final year of the agreement — five times the 2013 total.

It is certainly the case a supply deal represents no kind of certainty demand for that many vehicles will result, but even entering into the arrangement shows Tesla is confident popularity of the company’s vehicles will remain strong. The company just started selling in Europe this summer where the car quickly became a hit in Norway and CEO Elon Musk was recently in Germany making his case for the Model S there. Asia is next up for Tesla, where one Chinese buyer was so eager to be the first to own a Tesla, he paid $410,500 for the privilege.

What’s remarkable about the Panasonic-Tesla agreement is that the entire lithium-ion cylindrical battery industry (the type Tesla uses) was consuming 660 million cells a year and this agreement represents 500 million annually for Tesla alone. The cells are used mostly in laptop computers and rechargeable flashlights as well as Tesla’s cars. (Other electric vehicles use much larger cells). What isn’t clear at this point is whether the new agreement is for a unique-to-Tesla cell. I spoke with the company when it showed off its battery-swapping technology in June and execs discussed the possibility of a slightly larger cell that would allow for a simplified battery pack design. But as two recent Tesla vehicle fires have shown, the company also has taken great pains to limit the risk of the batteries exploding and the high cell count combined with a substance called “intumescent goo” helps insure this.

In addition, the cells Tesla currently use are a standard model called an 18650. If the company has committed to a unique design from Panasonic, it would presumably be at least a couple of years before it went into use to allow Tesla time for other manufacturers to ramp up production of the design. Even with the new supply agreement, the forthcoming $35,000 sedan some are referring to as the Model E will require perhaps another billion cells annually on its own. The agreement announced today makes no mention of that vehicle.

Finally, while it is worth mentioning the 100,000 figure is an extrapolation, the 18650 cells grow in capacity over time. Tesla might use some of that capacity to offer greater range to buyers but the improved battery performance also means that fewer cells could be needed as the agreement runs its course. In other words, these 2 billion cells might represent even more cars than the above-mentioned estimates. If demand for Model S and X proves less robust than Tesla hopes, it is certainly possible some of this battery production could be shifted to the Model E, but Tesla seems to be preparing for a bigger share of the luxury vehicle market than it could have imagined even 2 years ago.

Air Pollution in China Shuts Down City of 11 Million

Via LegalPlanet

The airpocalypse is back. What should Chinese leaders do about it?

Alex Wang - October 22, 2013

On Sunday, the start of the heating season in northern China brought the “airpocalypse” back with a vengeance (although some might say it never left). Harbin, the capital of Heilongjiang Province and home to 11 million people, registered fine particulate (PM2.5) pollution levels beyond 500 on the Chinese Air Quality Index, which is considered hazardous to human health. Measurements in some parts of the city reached 1,000 micrograms per cubic meter. As a result, authorities forced primary and middle school closures and the shutdown of the airport and local highways.

By contrast, Los Angeles, where I am now based and which typically has some of the worst air quality in the US, had US EPA AQI levels for PM2.5 between 48 and 108.

(STR/AFP/Getty Images)

China’s severe air pollution problems and the high cost to human health, economic productivity, and quality of life are by now well known. The question is whether Chinese leaders are prepared to do what it takes to solve the problem, and, if their stated resolve is genuine, will they have the ability to implement?

As I have talked about previously, there have been some positive signs in 2013. Regulators have engaged in an impressive flurry of policy-making on air pollution, including an extensive “Atmospheric Pollution Prevention Action Plan,” a timetable for developing new fuel quality standards, and emergency measures to protect citizens and reduce pollution on the worst air quality days. Leaders have pledged billions of US dollar equivalent in air pollution investments (see here). And authorities have announced an intention to link bureaucratic promotions to performance against air quality goals, perhaps one of the clearest signals that the leadership is taking air quality problems more seriously (I recently published an article describing how this system works).

But Chinese citizens are not interested in mere expressions of resolve. The key will be in the implementation, and skeptics know that China’s problems in this regard are legion.

In recent years, scholars have talked about China’s “authoritarian resilience,” or the ability of the leadership to learn and adjust to rapidly changing problems. Pro-China commentators like Eric Li have argued that China’s current governance system is well suited to the challenges China is facing. The proof, they say, is in China’s return to wealth and power under Communist Party rule.

China’s extreme air pollution problems, however, are a daily reminder to Chinese citizens (and the world) of a critical failure in governance. The leaders of the country therefore have the chance to prove themselves, and demonstrate that their approach to rule really can serve the people.

(This blog was cross-posted to the Asia Society’s Chinafile.com site. See here for the entire “conversation” with Isabel Hilton and others).

As I have talked about previously, there have been some positive signs in 2013. Regulators have engaged in an impressive flurry of policy-making on air pollution, including an extensive “Atmospheric Pollution Prevention Action Plan,” a timetable for developing new fuel quality standards, and emergency measures to protect citizens and reduce pollution on the worst air quality days. Leaders have pledged billions of US dollar equivalent in air pollution investments (see here). And authorities have announced an intention to link bureaucratic promotions to performance against air quality goals, perhaps one of the clearest signals that the leadership is taking air quality problems more seriously (I recently published an article describing how this system works).

But Chinese citizens are not interested in mere expressions of resolve. The key will be in the implementation, and skeptics know that China’s problems in this regard are legion.

In recent years, scholars have talked about China’s “authoritarian resilience,” or the ability of the leadership to learn and adjust to rapidly changing problems. Pro-China commentators like Eric Li have argued that China’s current governance system is well suited to the challenges China is facing. The proof, they say, is in China’s return to wealth and power under Communist Party rule.

China’s extreme air pollution problems, however, are a daily reminder to Chinese citizens (and the world) of a critical failure in governance. The leaders of the country therefore have the chance to prove themselves, and demonstrate that their approach to rule really can serve the people.

(This blog was cross-posted to the Asia Society’s Chinafile.com site. See here for the entire “conversation” with Isabel Hilton and others).

Battery-Stored Solar Power Sparks Backlash From Utilities

Via BloombergBy Ehren Goossens & Mark Chediak - Oct 8, 2013

|

The dispute threatens the state’s $2 billion rooftop solar industry and indicates the depth of utilities’ concerns about consumers producing their own power. People with rooftop panels are already buying less electricity, and adding batteries takes them closer to the day they won’t need to buy from the local grid at all. Photographer: Sam Hodgson/Bloomberg

|

|

California’s three biggest utilities are sparring with their own customers about systems that store energy from the sun, opening another front in the battle that’s redefining the mission of electricity generators. Edison International (EIX), PG&E Corp. and Sempra Energy (SRE) said they’re putting up hurdles to some battery backups wired to solar panels because they can’t be certain the power flowing back to the grid from the units is actually clean energy. The dispute threatens the state’s $2 billion rooftop solar industry and indicates the depth of utilities’ concerns about consumers producing their own power. People with rooftop panels are already buying less electricity, and adding batteries takes them closer to the day they won’t need to buy from the local grid at all, said Ben Peters, a government affairs analyst at Mainstream Energy Corp., which installs solar systems. “The utilities clearly see rooftop solar as the next threat,” Peters said from his office in Sunnyvale, California. “They’re trying to limit the growth.” California is the largest of the 43 states encouraging renewables by requiring utilities to buy electricity from consumer solar installations, typically at the same price that customers pay for power from the grid. The policy, known asnet metering, offers a way for households to reduce their bills. It underpinned a 78 percent surge in the state’s residential installations in the second quarter from a year earlier, according to the Solar Energy Industries Association. Battery Costs Solar systems with batteries attached have gained a foothold in the market as costs fall, allowing customers more flexibility for using their own power at night or when local supplies fail. The systems average about $12,000 to $16,000, adding about 25 percent to the cost of rooftop power plants, according to Outback Power Inc., an Arlington, Washington-based provider of battery-backed solar systems. Matthew Sperling, a Santa Barbara, California, resident, installed eight panels and eight batteries at his home in April. “We wanted to have an alternative in case of a blackout to keep the refrigerator running,” he said in an interview. Southern California Edison rejected his application to link the system to the grid even though city inspectors said “it was one of the nicest they’d ever seen,” he said. “We’ve installed a $30,000 system and we can’t use it,” Sperling said. Utilities say the storage systems open the possibility of fraud. The issue is whether all the electricity being sold through the net metering program is generated only by renewable sources, as required. Consumers in theory can fill the batteries with power from the grid and then send it back designated as renewable energy. With the solar-battery systems, there’s no way to determine the source of the energy. Solar suppliers say that’s not happening. Storage Rules Power-market regulations and the industry’s ability to monitor flows from solar systems haven’t kept pace with the technology, said Gary Stern, director of regulatory policy at Southern California Edison, a unit of Edison International. “Our rules are not really caught up to effectively include issues with energy storage,” Stern said in a phone interview from Rosemead, California. The company doesn’t want to “discourage solar” and is working with regulators to come up with “reasonable policies” for battery-storage systems, said Vanessa McGrady, a Southern California Edison spokeswoman. State regulators are aware of the problem and are working on guidance to offer both solar installers and utilities, according to Terrie Prosper, a spokeswoman for the California Public Utilities Commission in San Francisco. ‘Some Complaints’ There have been some complaints from developers in Southern California Edison’s territory that Edison has inconsistently applied the benefits of net energy metering to energy-storage projects,” Prosper said in an e-mail. The commission is working with all three utilities “to provide formal direction on these issues in the coming months.” The utilities said they would approve systems that have panels and batteries if they had two meters to verify that only solar energy is sold to the grid. Such a configuration would boost installation costs by at least $1,300, according to Neal Reardon, the state utility regulator’s interim supervisor of customer generation. The dispute is expanding as California promotes wider use of batteries. Regulators in June proposed that the top three utilities procure 1.3 gigawatts of storage capacity by 2020. The state has set a goal of obtaining 33 percent of its power from renewables by 2020, the nation’s strongest requirement. With more electricity coming from intermittent sources such as wind and sunlight, storage systems will be an important tool to manage the grid. Falling Prices Demand for the systems may grow as prices decline. Battery costs are forecast to fall 57 percent to $807 a kilowatt-hour in 2020 from $1,893 for a kilowatt-hour of storage capacity now, according to data compiled by Bloomberg. The global market for solar systems combined withenergy storage will rise to $2.8 billion in 2018 from less than $200 million this year, according to Boston-based Lux Research Inc. About 391 megawatts of solar panels were fitted at customer sites across the state last year, according the California Solar Initiative. The price to install residential projects has declined 15 percent to $3.71 a watt in the second quarter from $4.35 a year earlier according to the Washington-based trade group SEIA. Battery systems are the latest innovation that’s unraveling the traditional monopoly utilities have enjoyed in supplying consumers with electricity. Two decades ago, federal regulators opened the system to independent power producers, eating away at the utility’s control of generation. The battery systems will put more customers out of reach. Rejected Applications “What we are seeing now as a fairly rare event may be more common by the end of the decade,” said Southern California Edison’s Stern. Mainstream began hearing in May that Southern California Edison was rejecting some of its clients from the net metering program. As many as 60 projects with panels and batteries have been turned down by California utilities, the company estimated. PG&E Corp. (PCG), the owner of California’s biggest utility, has also rejected standard net metering applications from customers with both panels and batteries, and referred them to another program that requires an interconnection fee. “The key is that the full retail net energy metering credits and subsidies are only available to renewable facilities,” Lynsey Paulo, a PG&E spokeswoman, said in an e-mail. San Diego Gas & Electric, a unit of Sempra Energy, said it hasn’t received any such applications, and it would deny them if it did. Sempra slipped less than 0.1 percent to $85.43 at the close in New York. PG&E climbed 1.5 percent and Edison gained 1.1 percent. ‘State of Flux’ “Technically, a customer who now has a combined system that includes both rooftop solar panels and battery storage, the battery storage may not qualify for net energy metering under current rules,” said Stephanie Donovan, a spokeswoman for San Diego Gas & Electric. “The rules are in a state of flux.” Mainstream’s Peters said Southern California Edison is now rejecting systems that are identical to ones it had approved in the past. The developer had been installing two to three solar-storage projects a week in Southern California at the start of this year. That’s dropped to zero in recent weeks, and some orders have been canceled. “Net metering is the lifeblood of solar in America,” Peters said. “That’s why this seemingly inconsequential issue is getting so much attention.” Solar panel owners aren’t trying to “game the system,” said Adam Browning, executive director of the San Francisco-based lobbying group Vote Solar Initiative. “The next step is that people with solar and batteries will find a way to make it work without utilities.” To contact the reporters on this story: Ehren Goossens in New York at[email protected]; Mark Chediak in San Francisco at [email protected] To contact the editor responsible for this story: Reed Landberg at [email protected] Aug. 19 (Bloomberg) -- Danny Kennedy, co-founder of Sungevity Inc., talks about the growth outlook for the solar-power industry. Kennedy speaks with Tom Keene, Sara Eisen and Scarlet Fu on Bloomberg Television's "Surveillance." (Source: Bloomberg)

|

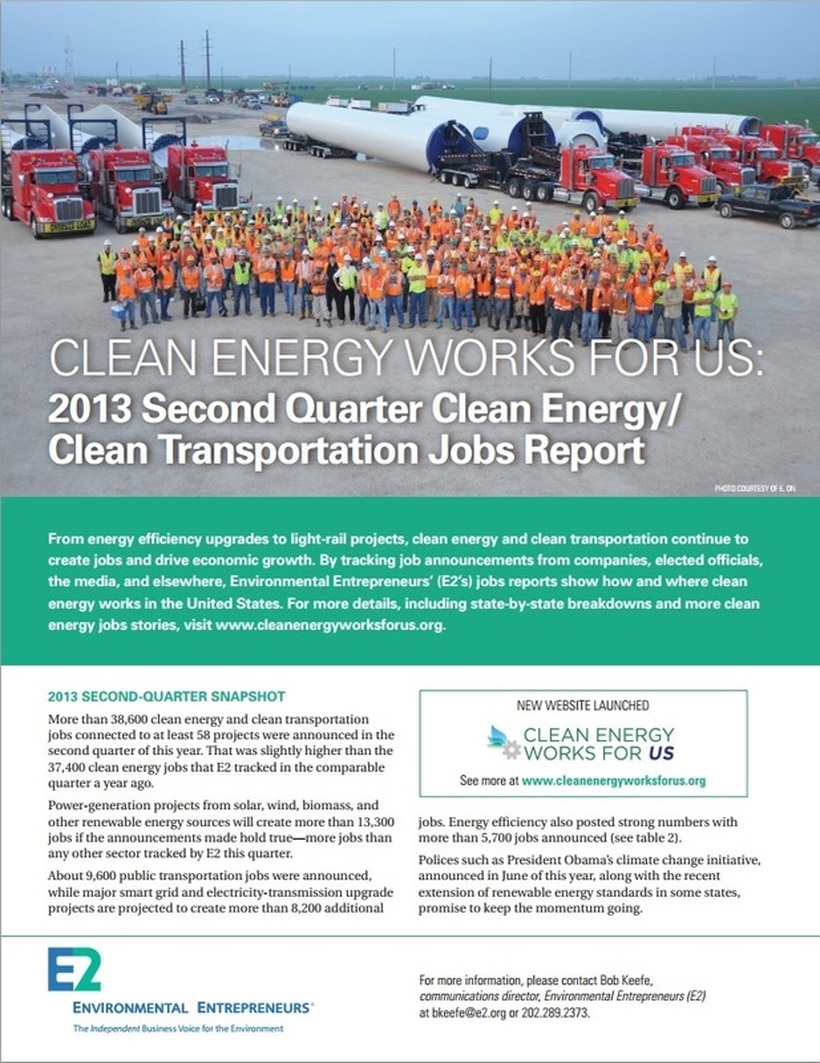

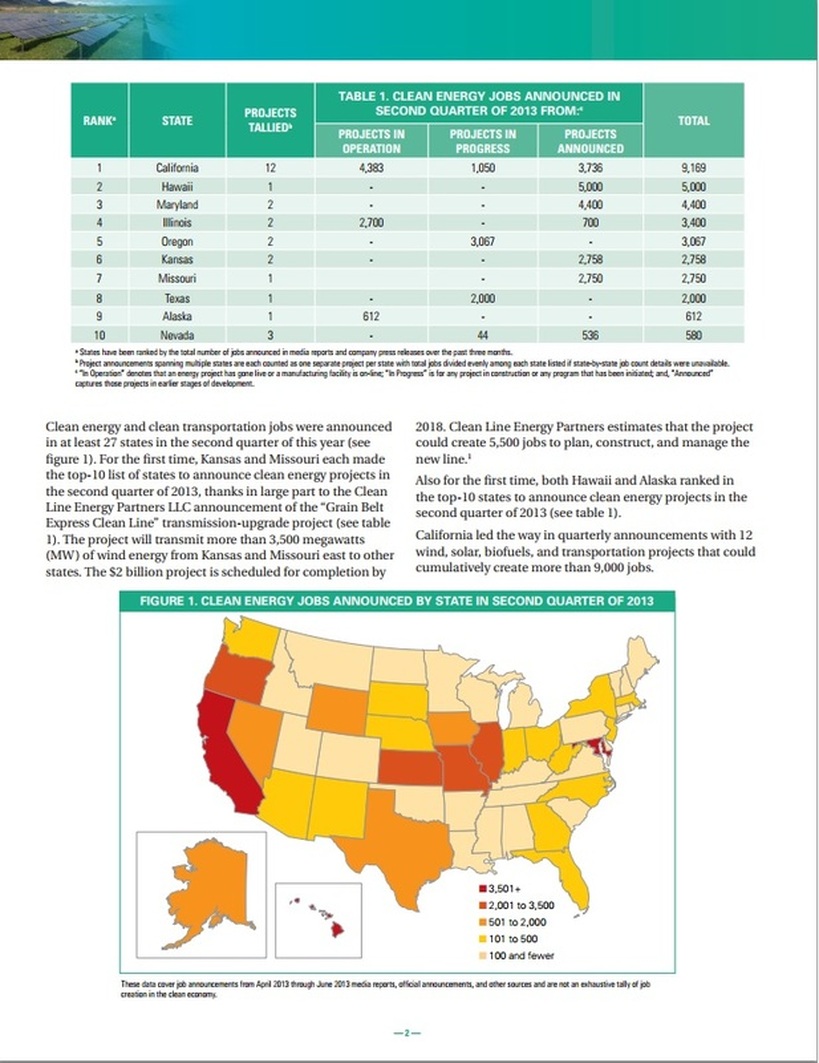

Clean Energy Jobs Quarterly Report Q2 2013:

Announcements from the second quarter of 2013

ISO Chair Bob Foster on California’s Energy Future without San Onofre

Via The Planning Report

July 3, 2013

Southern California Edison recently decided to shut down the San Onofre nuclear power plant after trouble with faulty generators. This month, TPR consulted Long Beach Mayor, ISO Chair, and former SCE president Bob Foster on the impact the closure will have on energy supply in the Southland, and how the state plans to counter the impending power loss. Foster also talks demand response, California’s energy future (he thinks: renewables), and the revolutionary role storage technology will play in fostering a green energy grid. While San Onofre presents a challenge, Foster notes California’s energy agencies are more capable than ever of meeting such challenges together.

Via The Planning Report

July 3, 2013

Southern California Edison recently decided to shut down the San Onofre nuclear power plant after trouble with faulty generators. This month, TPR consulted Long Beach Mayor, ISO Chair, and former SCE president Bob Foster on the impact the closure will have on energy supply in the Southland, and how the state plans to counter the impending power loss. Foster also talks demand response, California’s energy future (he thinks: renewables), and the revolutionary role storage technology will play in fostering a green energy grid. While San Onofre presents a challenge, Foster notes California’s energy agencies are more capable than ever of meeting such challenges together.

As the Mayor of Long Beach, Chair of California’s ISO, and the former president of Southern California Edison, few in California have more expertise than you to speak to the significance of SCE’s decision to permanently close San Onofre Nuclear Generating Station. What impact will decommissioning have on the state and region’s energy supply, and what provisions have been made by SCE and the State to meet demand heretofore reliant on nuclear power from San Onofre?

As far as the company, Edison, goes, they’ve made that decision based on economics. I’m not close enough to tell you whether it’s right or wrong. Obviously they felt that the long-term potential of that facility was in doubt, and it’s better to cut losses early. It’s been almost 30 years in operation, and there’s an issue with steam generators, which I’m sure will be the subject of litigation for some time. Whatever the company’s calculus is, they’ve already made it.

For the state and for the region, decommissioning does pose some issues short term and long term. Short term, we’ve been anticipating this at the ISO because it’s been doubtful that unit 3 and maybe unit 2 could restart, so for 2013 and 2014 we’ve reconfigured an existing 220 kV line called Barre-Ellis, going from two circuits to four. That gives us greater flexibility.

North of the facility, Huntington Beach units 3 and 4 were converted. Those are two old power plants that were retired. We’ve converted those to what are called synchronous condensers. Those will be able to provide voltage support. Just like water in a hose needs pressure to move, transmission lines needs voltage energy to move electricity. The problem with losing San Onofre is not just capacity—the system needs to be able to maintain its voltage levels to be able to function properly. Those synchronous condensers are like electric motors; they will provide that voltage support.

We’ve done a lot of capacitor bank upgrades at Santiago, Viejo, and Johanna substations—those have all been installed and have been in service since May.

There are new resources coming online. At El Segundo, the plant was repowered to 564 MW. That should be fully available at the end of this month. Sentinel is fully available with 800 MW, and a new plant in Walnut Creek at 500 MW is now fully on line and operating.

In addition, we’re going to do a number of Flex Alerts. Those are fully funded by the investor-owned utilities and authorized by the California Public Utilities Commission. And we’re going to utilize, to the extent that we possibly can, demand response, which involves having people cut back on their use in return for getting paid or receiving credit on their bill. Demand response and energy efficiency are part of the state’s mandated loading order as well. If we have to use it, we’ll turn to it. Obviously we’re going to try to make sure all the power plant facilities are well maintained and available for service. So that’s the short run.

In the long run, you have an issue—all the coastal plants, that’s about 7400 MW facilities from Ormond Beach all the way down to Encina, are all scheduled to go from the present system of once-through cooling with ocean water to a different system, probably cooling towers. Now how many of them get repowered, I don’t know. But that 7400 MW, and we’re going to need to either delay the once-through cooling, or repower these facilities.Advertisement

Now with San Onfore retiring the amount of ocean water used in once-through cooling drops substantially. Maybe there’s a reason for a delay—I’m not saying we are going to ask for a delay, but that’s one of the possibilities. All of the agencies involved—the Public Utilities Commission, the California Energy Commission, the ISO, the Air Board, the Water Board, and the Governor’s Office—are, over the next 90 days, going to crack a long term plan for dealing with the San Onofre retirement.

Now that could be a lot of things. It will probably include some upgrades and new transmission; it could well include some additional plants or some distributed generation at the substation level; new renewables where it could come online and work properly—all of those will be considered, as well as demand-response, which I personally think has great potential, particularly if we can get a market where people who can aggregate efficiency in demand response can get paid for it.

But I can’t tell you anything about how that’s going to work right now because it’s all going to be put into a long term plan, which will be presented to the various agencies. I’m fairly confident we’ll be able to solve this and deal with San Onofre being out. There’s a great advantage to having all the agencies working well together, which they have done for several years. As you know, I’ve been involved in energy for almost 30 years in this state and I don’t think I’ve seen the agencies work as well together as I have in the last three or four years. So I’m pretty confident we’ll be able to solve this.

This is a problem; it’s not a crisis. This can be managed, and we intend to do that.

Regarding how the “problem” will be managed, you have, in prior TPR and VerdeXchange interviews, advocated Demand Response. Elaborate why demand response is always an attractive but difficult alternative to pursue.

First, the demand response that we have now is largely just paying people not to operate. The demand response of the future, if we can create a market, is a combination of potentially having people cut back on their operations, but more importantly to start installing hardware for efficiency—replacing incandescent and even fluorescent lights with LEDs; putting in variable-speed motors. If you have a market, you can have very skilled entrepreneurs to aggregate those and get paid for it to compete for new generation for efficiency gains. Without it you’re relying on regulation or one-off programs. That’s one reason why our capacity market, which we are hopefully in the process of developing, is so important to demand-response. I don’t think we’ve even scratched the surface with demand-response and efficiency.

I’ve been involved with efficiency all my life. I was instrumental in the creation of Title 24. I think the efficiency gains in demand response hold a large potential to be able to meet our future needs. Advertisement

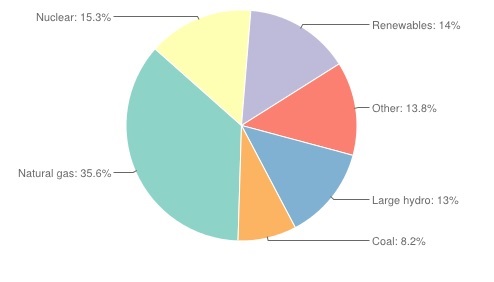

With San Onofre’s closure, what do you see the energy mix for California and Southern Californians being in the next decade? What policies and regulations will most affect the state’s energy portfolio mix?

We’re on a path for 33 percent renewables for 2020. I think we’ll likely exceed that. In addition, there’s a vast impetus for rooftop solar, speared on by a lot of issues, from the declining cost of solar and the rate structure itself.

The rate structure, its last two blocks are really high in most utility service areas. So it’s a very fertile ground to put independent systems in. When you add all that up, the future is going to be largely renewables, with gas-powered generation backing it up, and obviously some hydro. Until we can get effective and economically competitive storage systems, that, I think, will be the mix.

Once we get, and I hope we will, storage systems that are economically competitive, then the world changes. Then even a larger portion of renewables becomes doable and probable. In the foreseeable future it’s going to be substantial additions of solar, wind, geothermal, and other renewables on the edges, and gas-powered generation backing it up. The integration of those renewables, because of their intermittency, poses issues on the system; you have to ramp up and down.

We need new kinds of facilities, new gas facilities, to meet that need. And they’re being built. And ultimately, as I said, if we get storage that can solve a lot of those issues.

Elaborate on what is presently being built?

I mentioned transmission; upgrades on capacitors; being able to put devices at the distribution level which condition power—those things are all being installed and looked at. In addition on the generation side, we are adding in Walnut Creek, for example, a brand new 500 MW plant that can ramp up and down extraordinarily quickly. Those are the kinds of things you are going to need as you get more solar, particularly rooftop solar.

The grid has to be stable. Even on a spring day, not even a summer day, you see what we can in the ‘duck chart’, which is a graph that shows load over time, a substantial drop in demand because people are running off of their solar power systems. Around 4:30, you see it start ramping up as those systems become ineffective. It shows up on our system as a huge increase in demand. In 2016, that ramp might be 13,000 MW in two hours. So we have to have the capacity on the system to be able to meet that. There are a couple plants that have those characteristics, such as the Oakley power plant.

That’s what the ISO is responsible for. We’re responsible for reliability. We look at this every day and do our best to meet that. The agencies like the PUC, Energy Commission, Air and Water, and the Governor’s Office have been remarkably cooperative. This is the best organization and integration that I’ve ever seen.

As Mayor of the City of Long Beach, one of California’s largest cities, does this change in the energy mix and the closure of San Onofre affect your city?

Well, as Edison customers it affects us, but it affects all of Southern California, probably more so in southern Orange County and in San Diego. That’s a load pocket. It could be a problem; we recognize what the problem is; we’re managing to it; and I think we’ll be successful.

Lastly, with SCE June decision to decommission San Onofre, Is nuclear in California dead as a future energy source?

I’d never say anything is dead, but it’s certainly on life support.

As far as the company, Edison, goes, they’ve made that decision based on economics. I’m not close enough to tell you whether it’s right or wrong. Obviously they felt that the long-term potential of that facility was in doubt, and it’s better to cut losses early. It’s been almost 30 years in operation, and there’s an issue with steam generators, which I’m sure will be the subject of litigation for some time. Whatever the company’s calculus is, they’ve already made it.

For the state and for the region, decommissioning does pose some issues short term and long term. Short term, we’ve been anticipating this at the ISO because it’s been doubtful that unit 3 and maybe unit 2 could restart, so for 2013 and 2014 we’ve reconfigured an existing 220 kV line called Barre-Ellis, going from two circuits to four. That gives us greater flexibility.

North of the facility, Huntington Beach units 3 and 4 were converted. Those are two old power plants that were retired. We’ve converted those to what are called synchronous condensers. Those will be able to provide voltage support. Just like water in a hose needs pressure to move, transmission lines needs voltage energy to move electricity. The problem with losing San Onofre is not just capacity—the system needs to be able to maintain its voltage levels to be able to function properly. Those synchronous condensers are like electric motors; they will provide that voltage support.

We’ve done a lot of capacitor bank upgrades at Santiago, Viejo, and Johanna substations—those have all been installed and have been in service since May.

There are new resources coming online. At El Segundo, the plant was repowered to 564 MW. That should be fully available at the end of this month. Sentinel is fully available with 800 MW, and a new plant in Walnut Creek at 500 MW is now fully on line and operating.

In addition, we’re going to do a number of Flex Alerts. Those are fully funded by the investor-owned utilities and authorized by the California Public Utilities Commission. And we’re going to utilize, to the extent that we possibly can, demand response, which involves having people cut back on their use in return for getting paid or receiving credit on their bill. Demand response and energy efficiency are part of the state’s mandated loading order as well. If we have to use it, we’ll turn to it. Obviously we’re going to try to make sure all the power plant facilities are well maintained and available for service. So that’s the short run.

In the long run, you have an issue—all the coastal plants, that’s about 7400 MW facilities from Ormond Beach all the way down to Encina, are all scheduled to go from the present system of once-through cooling with ocean water to a different system, probably cooling towers. Now how many of them get repowered, I don’t know. But that 7400 MW, and we’re going to need to either delay the once-through cooling, or repower these facilities.Advertisement